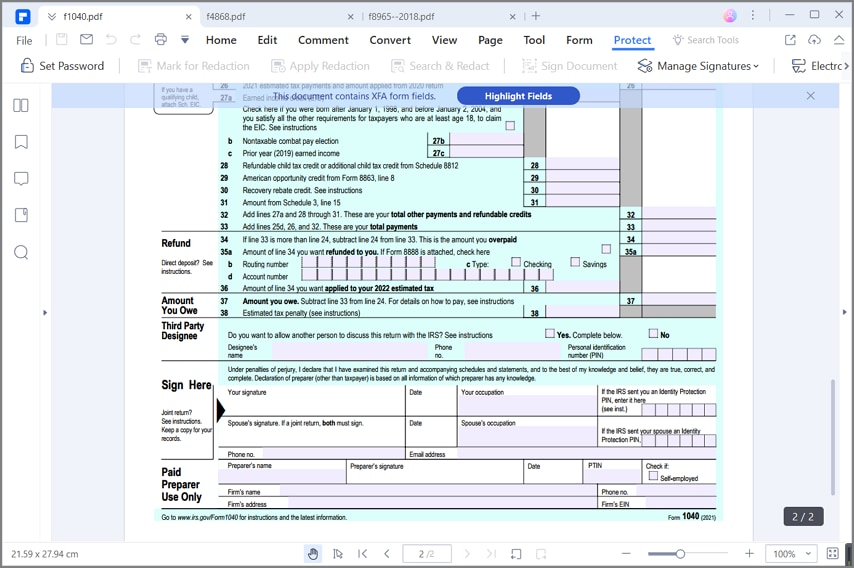

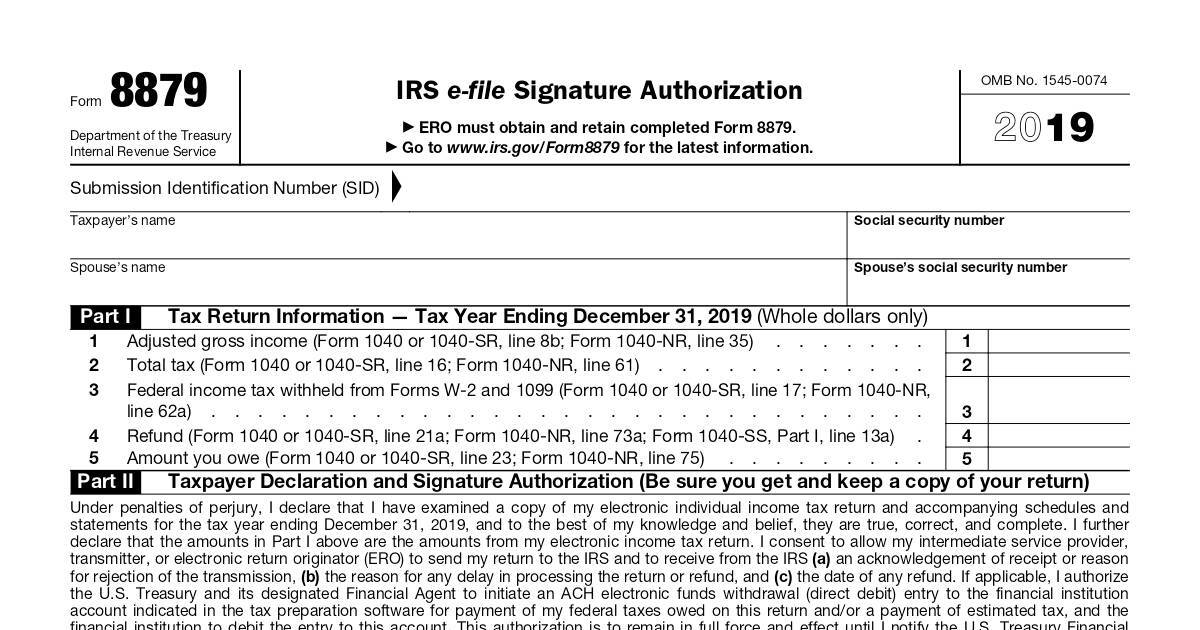

Irs 1040 Form Line 8B / Form 1040 - Lines 60a And 60b - Earned Income Credit (Eic ... - The form 1040 has about 79 lines, which you need to fill.. There have been a few recent changes to the federal form 1040. You are still able to print all forms from irs.gov, or submit an order on the webpage to have the irs mail. Form 1040 is how individuals file a federal income tax return with the irs. Subtract line 11a from line 8b. Form 1040ez was meant to simplify the filing process for filers who had relatively simple tax situations.

However, since more people have moved away from submitting on paper, those mailings have discontinued. Services are offered for free or a small fee. According to our statistics, only 8% of the. For more information or to find an litc near you, see the litc page at taxpayeradvocate.irs.gov/litcmap or irs publication 4134, low income taxpayer clinic list. All us residents and citizens must file form 1040 known as the u.s.

All us residents and citizens must file form 1040 known as the u.s.

Form 1040ez was meant to simplify the filing process for filers who had relatively simple tax situations. The form 1040 has about 79 lines, which you need to fill. Subtract line 11a from line 8b. You are still able to print all forms from irs.gov, or submit an order on the webpage to have the irs mail. For more information or to find an litc near you, see the litc page at taxpayeradvocate.irs.gov/litcmap or irs publication 4134, low income taxpayer clinic list. Hi this is evan hutcheson and i'm going to go it's not taxable it would go in line 8 b if it is taxable or whether or not is taxable actually it'll go on a day. For disclosure, privacy act, and paperwork reduction act notice go to www.irs.gov/form1040 for instructions and the latest information. Consult the instructions for form 1040 beginning on page 74 to calculate this penalty and enter it on line 79. Complete irs 1040 2019 online with us legal forms. You can reduce it further with either the standard deduction or the total of your itemized deductions. For tax years 2017 and before, you were eligible line 8b is for the nontaxable combat pay election, applicable to military filers only. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will. There have been a few recent changes to the federal form 1040.

This form contains sections which are required for the disclosure of the taxpayer's financial income status for a given year. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will. According to our statistics, only 8% of the. Only one or two lines are normally filled in this section. Form 1040 with instructions on filling out.

The form 1040 has about 79 lines, which you need to fill.

You can pay this amount by attaching a personal check made payable to the us treasury (ensure your name, address, and social security. How to prepare your 1040 in 2021. Irs 1040 form is a necessary document that must be filled by all us citizens to declare their income for the year. The irs form 1040 must be filed by all residents and citizens of the united states. Nonresidents would use line 17a to report total pension and annuity income and line 17b to report taxable pension and annuity. Subtract this amount from line 8b. For more information or to find an litc near you, see the litc page at taxpayeradvocate.irs.gov/litcmap or irs publication 4134, low income taxpayer clinic list. Filing extension and other relief for form 1040 filers pdf. Form 1040 is the standard internal revenue service (irs) form that individual taxpayers use to file their annual income tax returns. Thus, before filing the form check Complete guide to form 1040. Easily fill out pdf blank, edit, and sign them. This section requires wrapping up the irs form 1040.

You can reduce it further with either the standard deduction or the total of your itemized deductions. This form contains sections which are required for the disclosure of the taxpayer's financial income status for a given year. Although there is a standard form template, its variations can be changed according to the groups of taxpayers it was designed for. Form 1040 is the standard internal revenue service (irs) form that individual taxpayers use to file their annual income tax returns. It is divided into sections where can be filled the document consists of two pages for 23 lines in total.

However, since more people have moved away from submitting on paper, those mailings have discontinued.

Submitting form 1040 is a must if you receive income as a partner within a partnership, as a shareholder in the irs provides a pdf template of form 1040 for downloading and completing manually. ✓ choose online fillable blanks in pdf and add your signature instructions and help about irs 1040 2021 form. You can pay this amount by attaching a personal check made payable to the us treasury (ensure your name, address, and social security. Department of the treasury internal revenue service. Also, in contrast to the various other tax forms, irs form 1040 permits taxpayers to claim several expenditures and tax incentives, list deductions, and modify income. Go to www.irs.gov/form1040 for instructions and the latest information. Nonresidents would use line 17a to report total pension and annuity income and line 17b to report taxable pension and annuity. Although there is a standard form template, its variations can be changed according to the groups of taxpayers it was designed for. The irs form 1040 must be filed by all residents and citizens of the united states. We'll review the differences and show you on line 11 of form 1040, you will report your agi. Need an irs form 1040 walkthrough for 2021? Subtract line 11a from line 8b. You are still able to print all forms from irs.gov, or submit an order on the webpage to have the irs mail.

Nonresidents would use line 17a to report total pension and annuity income and line 17b to report taxable pension and annuity irs 1040 form. For more information or to find an litc near you, see the litc page at taxpayeradvocate.irs.gov/litcmap or irs publication 4134, low income taxpayer clinic list.